ACH Network Volume Rises 6.1% in Fourth Quarter of 2021 as Healthcare Claim Payments and B2B Lead the Way

Buoyed by strong gains in the healthcare and business-to-business sectors as well as Same Day ACH payments, ACH Network payment volume grew 6.1% during the fourth quarter of 2021.

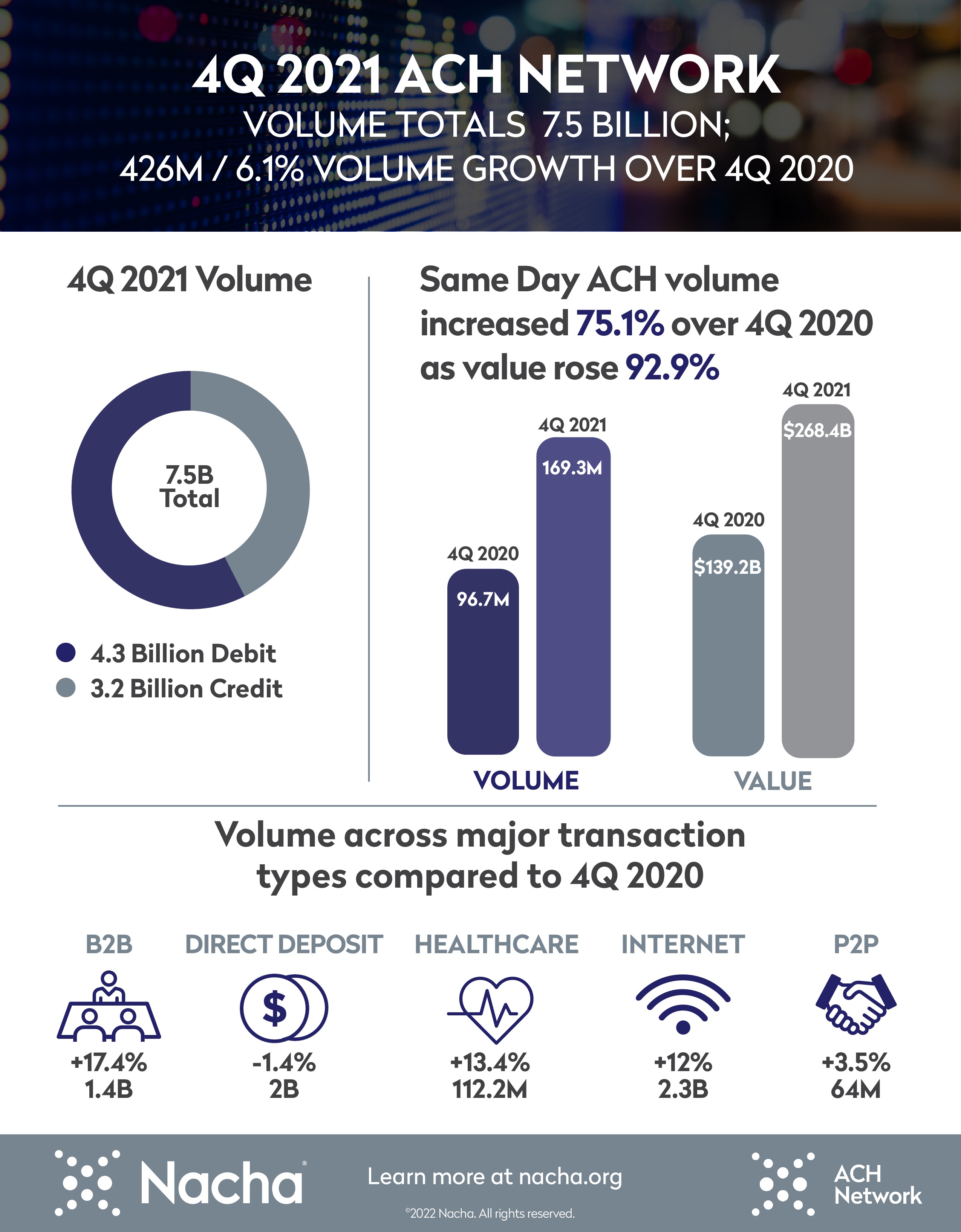

There were 7.5 billion ACH payments in the final quarter of the year, 426 million more than the same time in 2020. The value of those payments, $18.9 trillion, is a 13.4% increase.

“The fourth-quarter results reaffirm what we have been seeing almost from the start of the pandemic: a sustained move to electronic payments among businesses, consumers and governments,” said Jane Larimer, Nacha President and CEO. “The nation is well-served by the modern ACH Network.”

Healthcare claim payments to medical and dental practices and facilities recorded a 13.4% rise in the fourth quarter, as these professionals continue to recognize the convenience and safety of receiving their funds electronically. With 112.2 million payments, this is the second consecutive quarter above the 100 million mark.

Overall, B2B payments—which were on the rise even before the pandemic accelerated the move away from paper checks—increased by 17.4%.

Direct Deposit volume declined 1.4% from a year earlier when the second round of economic impact payments was included in the volume. Additionally, expanded unemployment benefits expired during the third quarter of 2021.

Same Day ACH volume and value rose 75.1% and 92.9% respectively in the fourth quarter with 169.3 million payments valued at $268.4 billion.

“Businesses are increasingly seeing the power of Same Day ACH as a safe and reliable way to make faster payments,” said Larimer.

Nacha expects to release full-year ACH Network results for 2021 on or about Feb. 3, 2022.

About Nacha

Nacha governs the thriving ACH Network, the payment system that drives safe, smart, and fast Direct Deposits and Direct Payments with the capability to reach all U.S. bank and credit union accounts. Nearly 27 billion ACH Network payments were made in 2020, valued at close to $62 trillion. Through problem-solving and consensus-building among diverse payment industry stakeholders, Nacha advances innovation and interoperability in the payments system. Nacha develops rules and standards, provides industry solutions, and delivers education, accreditation, and advisory services.