Nacha Resources for Treasury, Finance and Payroll Professionals

Treasury and finance payments practitioners and payroll professionals at corporations, larger businesses and governmental organizations (federal, state and local) are big users of ACH payments—from paying bills and employees, to receiving payments for the sale of their product/service.

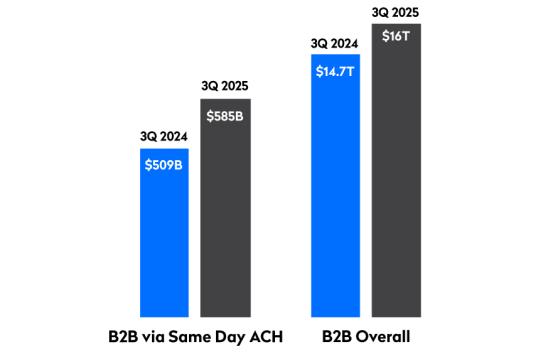

This section provides the latest ACH Network advancements you care about. We have information on a range of topics, including how the Same Day ACH $1 million per payment limit can be used for invoice and supplier payments, tax payments, payroll funding, merchant funding, and cash concentration. There’s also the latest on remittance, payment data validation and risk management strategies.

ACH Rules for Payments Practitioners

Familiarity with the Nacha Operating Rules and Guidelines is vital to understanding your organization’s electronic payment opportunities and risks. ACH payments benefit everyone in so many ways, and billions of payments worth trillions of dollars are successfully transacted each year. But do you know your organization’s responsibilities and rights in the ACH Network when dealing with exceptions?

Stay up to date and receive complimentary ACH Rules communications for payments practitioners by signing up for Rules News and Risk Management Tools and follow Nacha Rules on LinkedIn.

Nacha seeks input from finance and treasury professionals. By signing up for up for Rules News and Risk Management Tools, you can receive notifications to respond to Nacha Requests for Comment. This is a unique opportunity for you to shape the ACH Network.

ACH Rules Briefings, Webinars and Other Resources

Briefings

Briefings provide detailed information on Rules, the impact, purpose and attention required. Learn more by downloading each briefing or visiting each Rule's dedicated webpage.

- Increasing the Same Day ACH Dollar Limit: Download Briefing | Rule Page

- Expanding Same Day ACH: Download Briefing | Rule Page

- Micro-Entries: Download Briefing | Rule Page

- Supplementing Fraud Detection Standards for Web Debits: Download Briefing | Rule Page

- Supplementing Data Security Requirements: Download Updated Briefing | Rule Page Phase 1 | Rule Page Phase 2

- Reversals: Download Briefing | Rule Page

- Limitation on Warranty Claims: Download Briefing | Rule Page

Quarterly Webinar

Nacha Operating Rules: Quarterly Insights for ACH Network End-Users

There are a number of changes coming to the Nacha Operating Rules that treasury, finance and payroll professionals need to understand. These webinars highlight what the new Rules are, their benefits and impacts to you, and how to prepare from both the sending and receiving perspectives.

Nacha presents a free webinar for end users every quarter to provide the most current information on ACH Rules. Save the upcoming dates to stay up to date: March 17, June 23, September 15, December 16. You can register for the next webinar or listen to the recording of the previous one by clicking on the links below.

Listen to the December 16 Recording | Register for the March 17 Webinar

Additional Resources

Learn more about all the upcoming ACH Rules changes and proposed Rules that are open for comment, and find even more resources in the Account Validation Resource Center or view videos on YouTube.

New Rules Proposed Rules Account Validation Resource Center

Connect With Us

Stay up to date with the latest information on the Nacha Operating Rules.

Remittance Data

Achieving straight-through processing by having the payment and remittance together are payments practitioners' utopia.

Nacha has tools available to help you develop the strategies and processes you’ll need to fully capitalize on your payments mix, create efficiencies and achieve cost savings.

- Do you need to exchange payments and information in a specialized way? Banking conventions, or the formats used to present data in an Addenda Record, are one way that Nacha has adapted the ACH Network to meet specific needs. Using the right convention with the right payment process means smarter, more efficient electronic transfers. Learn More.

- Are you seeking to leverage ISO 20022 to facilitate translation of ISO 20022 pain.001 (credit) and pain.008 (debit) messages into ACH transactions? The ISO 2022-to-ACH Mapping Guide and Tool provides standardized guidance for translating ACH reject/return messages to corresponding ISO 20022 payment status and treasury reporting messages (pain.002 and camt.053) Learn More.

Payments Data Validation

Validating payment-related information quickly and securely is key to mitigating fraud and enhancing the certainty of payment routing.

- Phixius by Nacha enables instantaneous verification of routing and account numbers and validation of account ownership. This trusted peer-to-peer network enables businesses to exchange and verify payment-related information securely, instantly, and across multiple payment types. Phixius’ applications provide for the exchange and verification of payment-related information, risk management, and fraud prevention — all in one place. Learn More.

- The Nacha Account Validation Center was designed for businesses/governments of the ACH Network looking for a one-stop shop resource center that includes third-party validation service vendors, Web Debit Rule information and specific information for merchants and billers. Learn More.

Authorization and Authentication

Authorization

Authorization involves determining what information should be collected and retained so that there is adequate proof in the event that a transaction is challenged--a common challenge among ACH Network participants that originate or process WEB ACH consumer debit transactions. The ability to prove that a transaction was properly authorized is highly dependent on the attributes of the authorization process and any underlying processes used to validate identity, all of which may vary among institutions, transaction types and operating models. Learn more.

Authentication

Authentication in the ACH Network is a common challenge among all ACH Network participants, particularly for WEB transactions. The eResource covers relevant risk management requirements for WEB in an effort to help participants better understand authentication technologies that are available on the market. Learn more.

Fraud and Risk Information

Fraud mitigation is of paramount focus for all. This section provides key resources to protect your company, employees and customers.

- Nacha's Risk Management Resource Center has a wealth of helpful information, including articles, guides, checklists and much more.

- Synthetic fraud, business email compromise, ransomware, money mule, account takeover and other scams are just a handful of the ways criminals are seeking to do financial and reputational harm. Learn about the latest threats so you can protect your organization. Learn More.

- Looking for Third-Party Senders that are Nacha Certified and demonstrate that they have effective ACH Rules compliance and risk management, and sound corporate governance? Or are you a Third-Party Sender and want to become Nacha Certified so you can set yourself apart in today’s competitive market? Learn More.

Peer Learning, Networking and Ways to Participate

As a payments practitioner, you understand the value of being able to share challenges and successes with others so that you can learn from one another in a collaborative environment. Nacha is known for its ability to bring in diverse stakeholders to tackle the thorny payments issues.

- When you join the Payments Innovation Alliance, you'll team with diverse stakeholders from financial institutions, fintechs and corporates to support payments innovation, collaboration and results. Alliance members support the ACH Network and the payments industry worldwide through discussion, debate, education, networking, and special projects. Learn More.

-

The Nacha ACH Network Advisory Board serves as a venue for senior executives from a balanced cross section of corporations, fintechs and other technology providers to communicate directly with the Nacha Board of Directors. ANAB provides input and feedback on topics significant to the ACH Network and to those who use or support and enable the use of ACH payments by others. Learn More.

- Do you want advisory expertise from across the payments spectrum to provide help across all payment rails? Visit Nacha Consulting for expert advice on international payments, payments strategy, custom training, and more. Sign up for a complimentary 15-minute consultation.

Payments Education and Accreditation

- Looking for actionable, leading-edge education with more than 120 sessions presented by payments industry leaders and an exhibit hall for of solutions, including a Small to Large Business Perspectives educational track? Look no further! Register for Smarter Faster Payments. Learn More.

- As a payments professional, increase your marketability while benefitting your employer with these accreditations and certificates:

- Demonstrate effective management of the ACH Network through the Accredited ACH Professional (AAP).

- Showcase your risk management profile across payment types with the Accredited Payments Risk Professional (APRP).

- Demonstrate your proficiency in the faster payments field with the Faster Payments Professional certificate (FPP).