HOW ACH PAYMENTS WORK

Whether you’re collecting your salary, paying your bills, moving money around or a whole lot more, the ACH Network is busy working in the background. It’s making sure your mortgage and utility payments get paid by Direct Payment (ACH debits), and your pay and tax refunds arrive by Direct Deposit (ACH credits). But did you ever wonder how it all works?

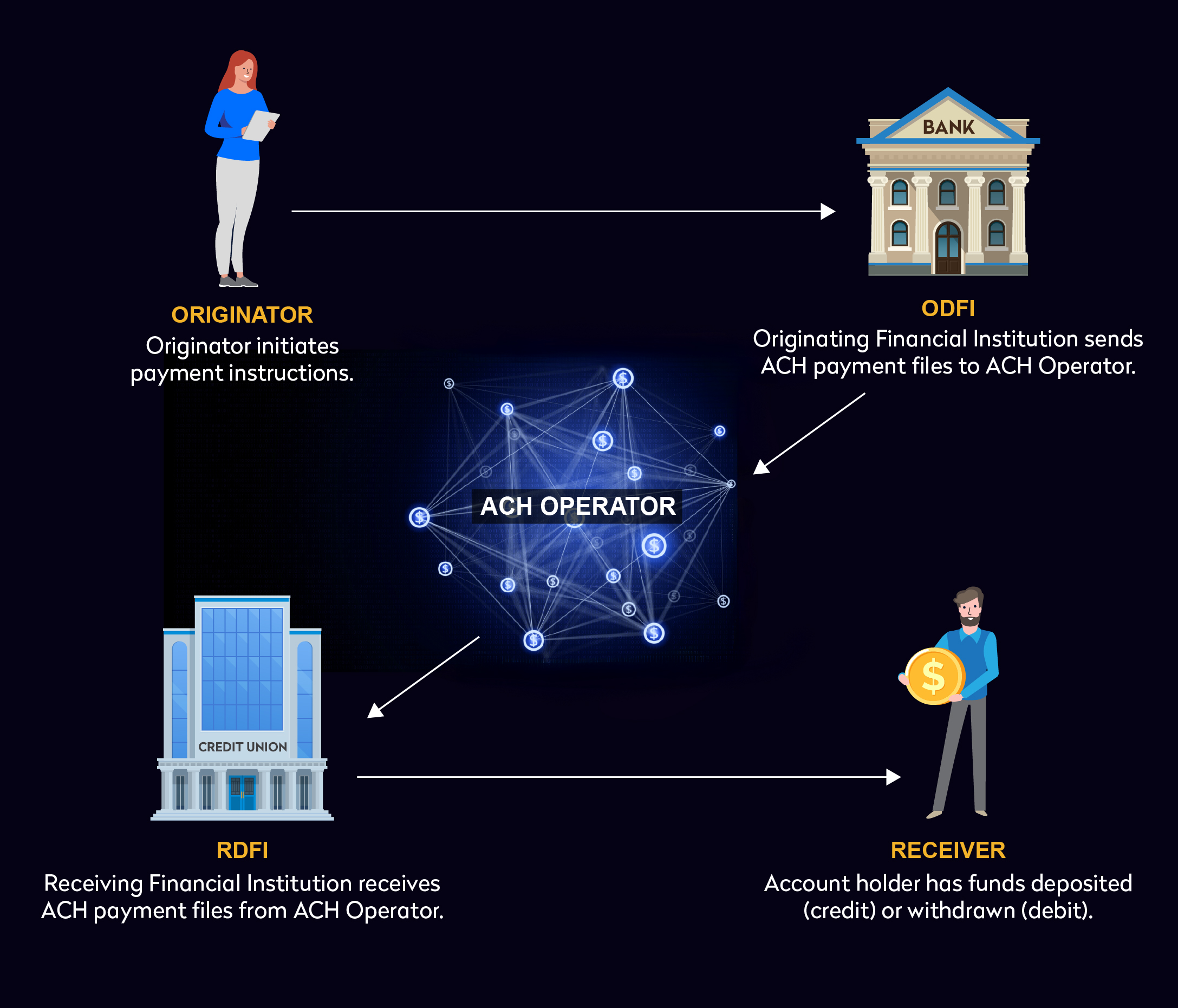

For ACH credits, let’s use Direct Deposit as an example. When you started work you provided your employer with your banking information. Before each payday, the employer sends that information, along with the amount you’re owed and your pay date, to its bank. It does this not only for you, but for all of your co-workers using Direct Deposit. Your employer is the “Originator” and its bank is the “ODFI” (Originating Depository Financial Institution).

The ODFI receives all these payment files from many employers, and then sends them to an ACH Operator. There are two ACH Operators: the Federal Reserve and The Clearing House.

The ACH Operator sorts all those transactions, making sure each goes to the correct place. In the case of your payment, the ACH Operator sends a file to your bank or credit union, instructing it to credit the funds to your account on payday. Your bank or credit union is the “RDFI” (Receiving Depository Financial Institution). The RDFI places the money in your account, making you the “Receiver.”

Learn how Direct Deposit works for you. Visit our specially dedicated website DirectDeposit.org.

For ACH debits, let’s use the example of paying your electric bill. You might have a standing authorization for the utility to withdraw the payment each month from your bank or credit union account. Or you might go to the utility’s website each month and authorize a single payment. Either way, the utility will follow your instructions, and when time comes for them to collect the money, they become the “Originator,” because they are originating an ACH payment instruction.

The electric company continues the process by sending your payment instructions, along with payment instructions from other customers, in the form of an ACH file to its bank. The utility’s bank is the “ODFI” (Originating Depository Financial Institution). The ODFI most likely combines the payment instructions from the utility with similar payments from other companies and then sends that combined ACH file to an “ACH Operator.” There are two ACH Operators: the Federal Reserve and The Clearing House.

The job of the ACH Operator is to sort all those payment instructions so that each one gets sent to the correct destination. In the case of your payment, the ACH Operator sends the payment instructions to your bank or credit union account, which is known as the “RDFI” (Receiving Depository Financial Institution). The RDFI will withdraw the funds from your account to pay the bill, making you the “Receiver.”

Find out more about Direct Payment at our specially dedicated website DirectPayment.org.

- Paydays that otherwise would be on a weekend or holiday are paid on the prior Friday, while bill payments are due and collected on the next business day, in each case favoring the employee/consumer.

- If payday is on a Friday, payroll payments made by Direct Deposit are available in employees’ accounts by 9 a.m. on that day in virtually all cases. For example, if your payday is on a Friday before Labor Day weekend, and you receive it through Direct Deposit, the money will be available in your account by 9 a.m. on Friday to withdraw or cover other payments.

- Employees may notice their Direct Deposits show as available before payday. Because payroll Direct Deposits are common and routine, some banks and credit unions may advance their own funds to the employee before settlement actually occurs, resulting in early availability.

Nacha estimates 80% of all ACH payments, both credits and debits, settle in one banking day—or less (by regular and Same Day ACH).

ACH credits comprise just under 50% of ACH payments and can settle the same day, the next banking day, or in two banking days, but the substantial majority of ACH credits settle in one banking day or less (note, the U.S. Treasury is the only entity that has the ability to initiate ACH credits with a settlement date of more than two banking days in the future).

Debits typically comprise just over 50% of ACH payments are settled either the same day or the next banking day. By Nacha Rule and enforced by ACH Operator edits, ACH debits cannot have a settlement date that is more than one banking day into the future.

Where does Nacha fit into all of this? Nacha governs the ACH Network, which is the way ACH payments move and settle. While Nacha doesn’t actually process the ACH payments, payments on the ACH Network are handled according to the Nacha Operating Rules and Guidelines. All participants in the ACH Network must follow the Nacha Rules.