Business-to-Business (B2B)

The 2025 Association for Financial Professionals (AFP) Digital Payments Survey found that just 26% of business-to-business (B2B) payments in the United States and Canada are made by check. In 2004, it was 81%.

It’s no wonder given that they come with all the necessary remittance information. There’s also safety and savings. AFP recently found checks are the payment type most impacted by fraud. AFP also reported that the median cost of initiating and receiving an ACH payment for businesses is between 26 cents and 50 cents, while the median cost of issuing a check is between $2.01 and $4.

Helping business get done.

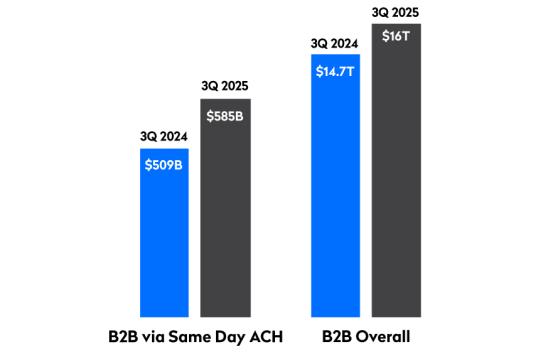

Companies of all sizes have long relied on the rock-solid ACH Network to receive payments and pay vendors/suppliers. B2B payments are now the ACH Network’smost significant growth segment.

2025 Details

YoY Growth:

Payments: 9.9% Dollars: 8.4%

Total Payments:

8.08 billion

Total Dollars Transferred:

$63.11 trillion