B2B + SDA = Awesome

Author

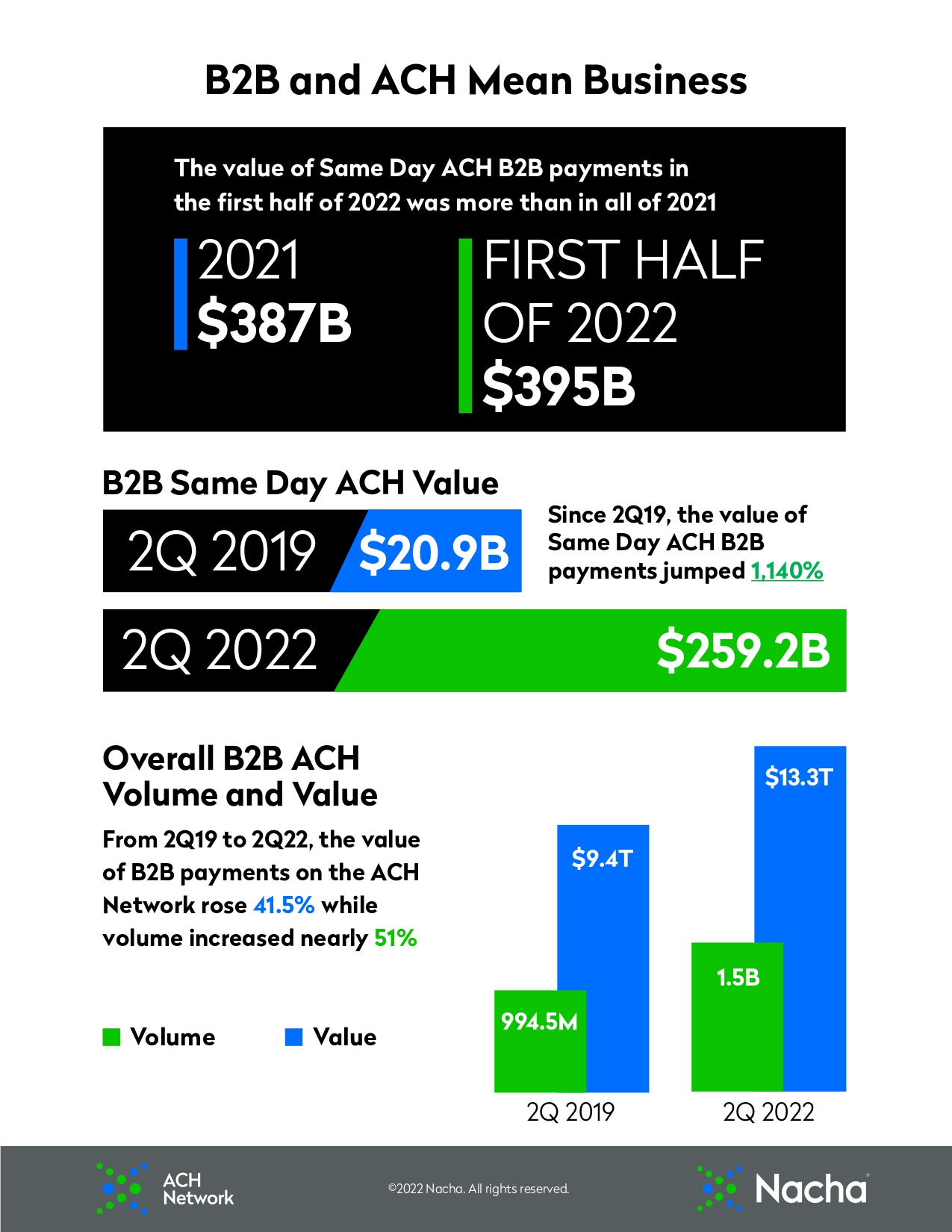

It isn’t every day that you see an increase of 1,140%. But when you look at some recent gains by Same Day ACH used for business-to-business (B2B) payments that’s exactly what happened.

Back in the second quarter of 2019, Same Day ACH for B2B payments totaled $20.9 billion in value. Since then, the increases have been steady, to put it mildly.

Just days before the end of the first quarter of 2020, the per payment limit for Same Day ACH rose from $25,000 to $100,000. From the first to the second quarter of that year, the value of B2B payments by Same Day ACH jumped 52% to $39.2 billion.

Then, shortly before the first quarter of 2022 ended, there was another hike in the Same Day ACH limit, this time to $1 million per payment. When the second quarter of this year was over, the value of B2B payments by Same Day soared 90% from the first quarter, to $259.2 billion. And that’s up 1,140% in three years.

The volume increase during that time is also noteworthy: up 287%, from 12.3 million to 47.6 million Same Day B2B payments.

Want another incredible—but true—stat? In the first half of 2022, Same Day ACH B2B payment value totaled $395 billion, which is $8 billion more than all of last year.

“The numbers are awesome,” said Michael Herd, Nacha Senior Vice President, ACH Network Administration. “What we’re seeing clearly here is that there is that businesses and other organizations are utilizing the $1 million limit for Same Day ACH. Same Day ACH is helping meet the demand for faster payments.”

Use cases for higher-dollar Same Day ACH B2B payments include invoice and supplier payments, tax payments, payroll funding, merchant funding, and cash concentration. Herd also noted that in a recent survey, Nacha’s Risk Management Advisory Group (RMAG) found that all ODFIs surveyed were originating SDA payments above the prior limit, and that the Same Day increase to $1 million posed no greater fraud risk than the earlier $100,000 limit.

It’s all part of the meteoric rise of ACH B2B payments, which began before the pandemic, but truly accelerated during it.

Returning to second quarter of 2019, there were $9.4 trillion in B2B payments on the ACH Network, both Same Day and standard. By the end of 2022’s second quarter, total value of B2B was $13.3 trillion, up 41.5%. At the same time, volume was up nearly 51%.