ACH Network Moves 7.6 Billion Payments in Third Quarter of 2022; Strong Growth Continues for Same Day ACH

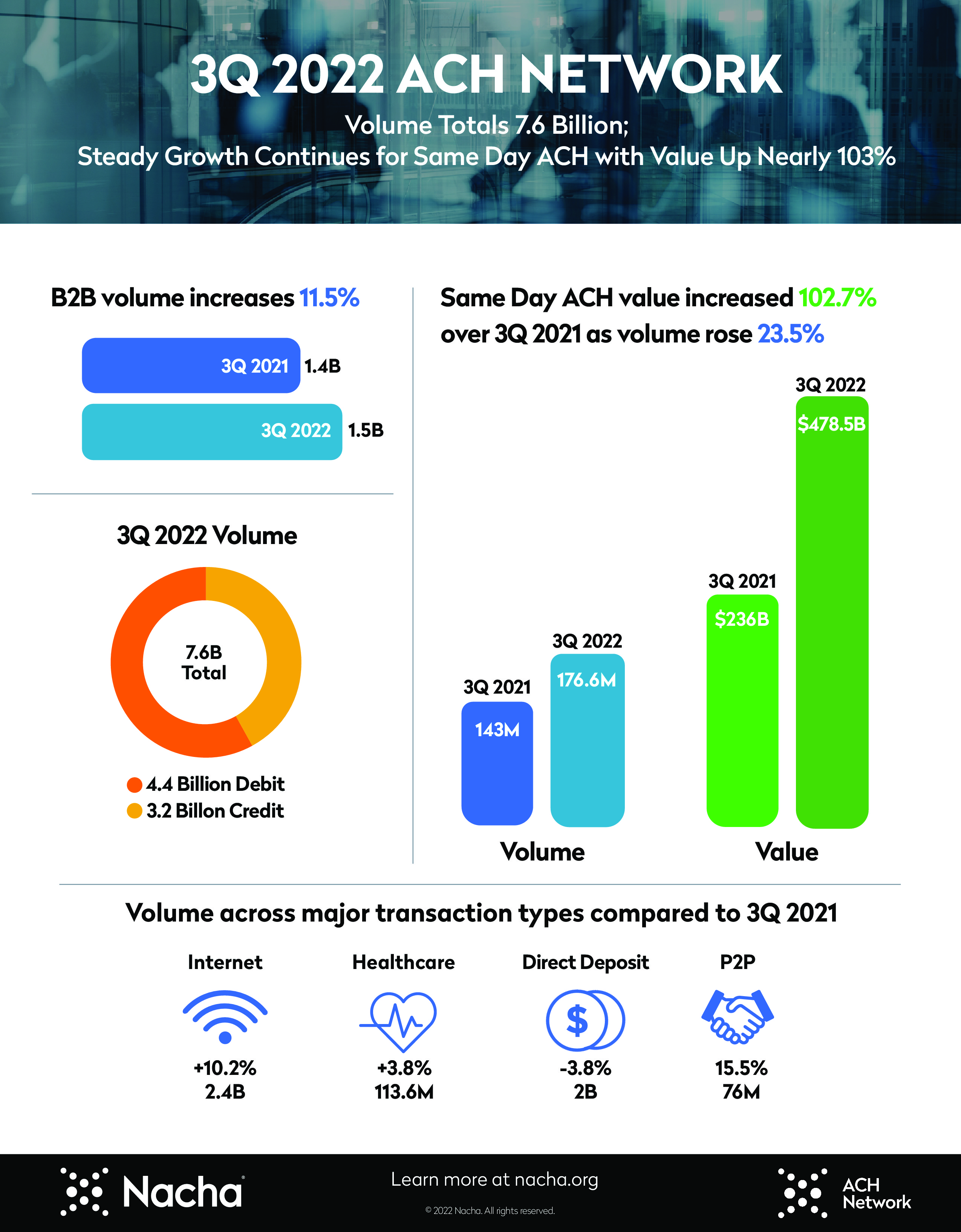

HERNDON, Virginia, Oct. 25, 2022 – Steady growth continued for the ACH Network in the third quarter of 2022, with 7.6 billion payments processed valued at $19.2 trillion. Those are increases of 4.2% and 6%, respectively, from a year earlier.

Same Day ACH showed particularly robust growth. There were 176.6 million same-day payments, up 23.5% from the third quarter of 2021. The value of those payments—$478.5 billion—reflects a 102.7% rise from a year ago.

“As more users of the ACH discover Same Day ACH, they are seeing the value it provides,” said Jane Larimer, Nacha President and CEO. “Same Day ACH payments so far in 2022 have moved more than $1.25 trillion. With a $1 million capability for Same Day ACH payments and settlement with funds availability four times daily, the ACH Network is helping to meet America’s faster payment needs.”

Business-to-business (B2B) ACH payments increased 11.5% to 1.5 billion as organizations large and small continued moving away from checks in favor of faster and safer ACH payments. This is consistent with the 2022 Association for Financial Professionals (AFP) Digital Payments Survey, released earlier this month, which showed that just 33% of B2B payments in the United States and Canada are made by check, down from as high as 81% in 2004. Among the benefits cited most were settlement speed, more efficient reconciliation, and fraud control.

Other notable third-quarter increases include a 10.2% rise in internet payments to 2.4 billion and a 15.5% jump in person-to-person (P2P) payments to 76 million.

“These quarterly results once again show that the modern ACH Network is there for individuals and businesses who rely on it day in, day out, to quickly and securely make and receive payments,” said Larimer.