ACH Rules Compliance Overview

Violation Submitted

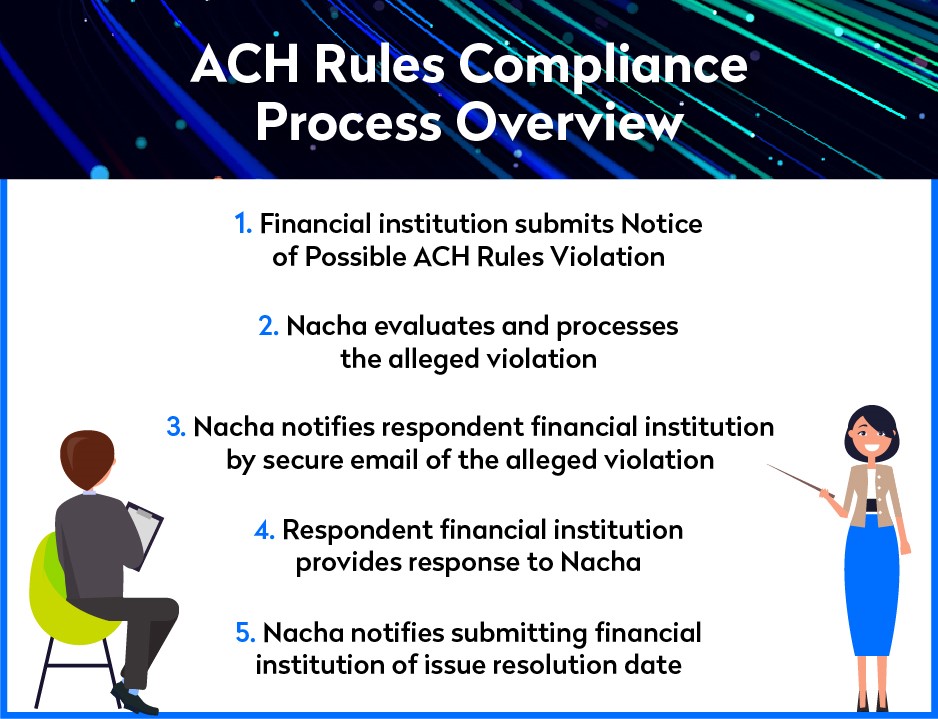

A case begins with a bank or credit union contacting ACH Rules Compliance to report an allegation that another bank or credit union violated the Nacha Operating Rules. Violations can be submitted online or by submitting the Report of Possible Rules Violation form along with documentation supporting the violation via email ([email protected]).

Sometimes financial institutions will want to recover costs or damages. To do that, Nacha recommends the organization look at arbitration.

Violation Evaluated

Nacha’s Compliance team evaluates each violation it receives to determine if it appears that a violation of the Rules has occurred. If a violation of the rules doesn’t appear to have occurred, the submitter is notified in writing. If a violation does appear to have occurred, compliance staff will ensure that proper documentation is available to support the alleged violation.

FI Notified of Alleged Violation

Depending on the level of the violation, the financial institution will receive either a Notice of Possible Rules Violation or a Notice of Possible Fine. Both notices will include a separate response form that allows the financial institution to address the alleged violation. The Notice of Possible Rules Violation is considered a warning letter and is not subject to a monetary fine. The Notice of Possible Fine is subject to a monetary fine and will be reviewed by the ACH Rules Enforcement Panel.

FI Responds to Alleged Violation

Notices sent to financial institutions citing alleged Rules violations will include a response form that allows the financial institution to either acknowledge or deny that a violation of the Rules has occurred. If the financial institution acknowledges the violation, a resolution date and a plan to resolve the issue and a date for completion is provided. If the financial institution denies the violation, proof that the violation did not occur must be provided. Nacha staff will review the proof and determine if the denial should be accepted.

Resolution

Once Nacha has a resolution date from the responding financial institution, this information will be shared in writing with the submitter of the violation. If this issue continues past the resolution date, Nacha urges the submitter to contact Nacha or submit a subsequent violation.