There’s More to the Numbers: What the Latest ACH Network Results Tell Us

Author

By now you’ve likely seen the ACH Network’s second quarter results for this year. While the 9.9% overall growth rate is proof that the ACH Network is thriving, it doesn’t tell the full story. To do that, you need to take a closer look at some of the numbers that factor in.

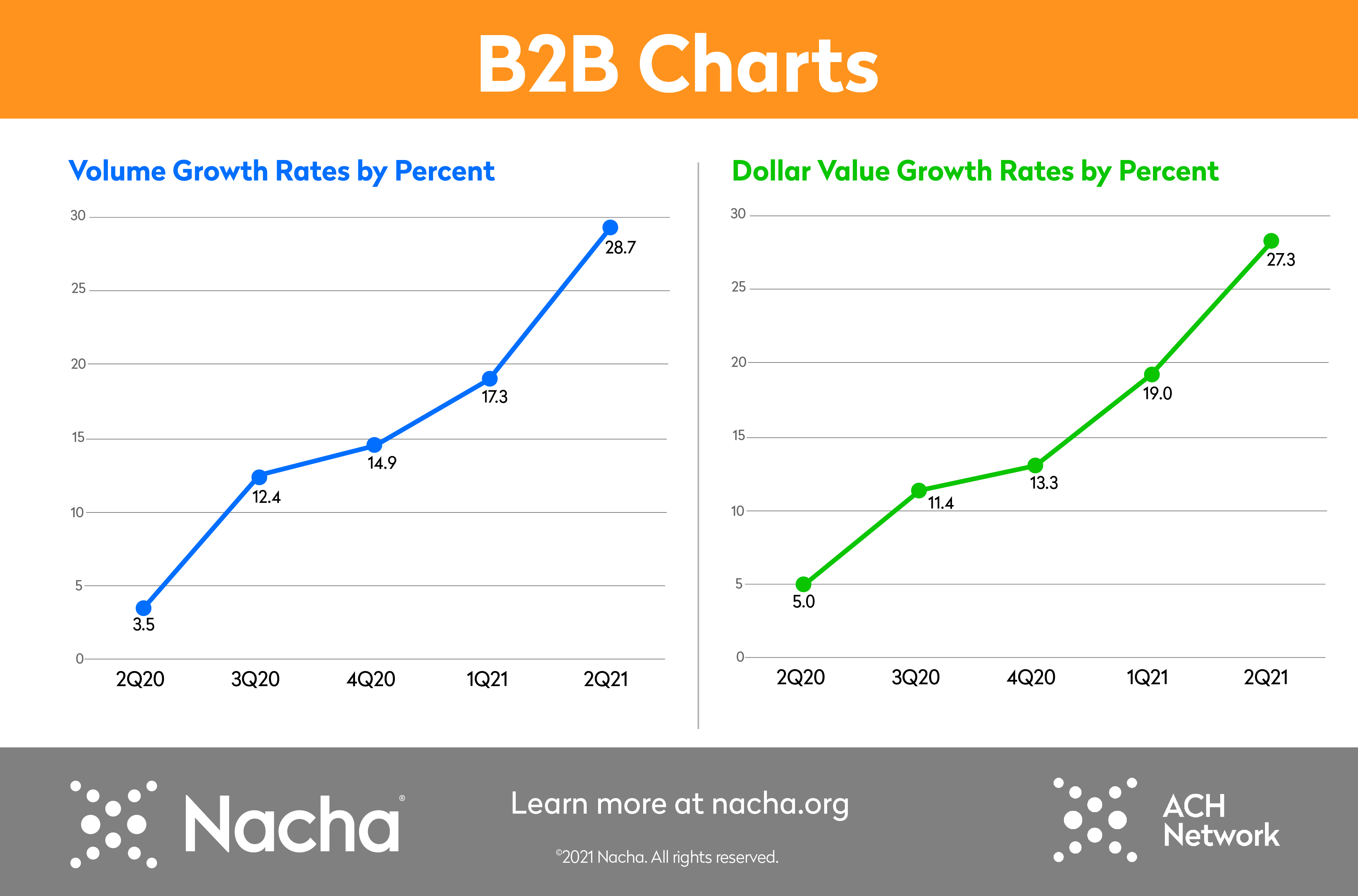

Business-to-business, or B2B, payments is a great place to start, given the phenomenal growth there. In the second quarter there were 1.3 billion B2B ACH payments, a 28.7% increase over the same time in 2020. While B2B payment volume on the ACH Network has been growing for years, this “hockey stick” inflection curve, as shown on the left side of the chart below, is evidence of a more fundamental change.

The dollar flows, seen on the right side of the chart, are just as impressive. The $12.6 trillion in second quarter B2B payments is up 27.3% from a year earlier.

Certainly, much of this can be attributed to the way the world began changing in March 2020. Businesses saw the need to quickly switch to electronic payments, as employees were largely away from offices and unable to issue paper checks. Similarly, businesses wanting to get paid in a timely manner didn’t want to wait for often delayed mail and then have to send staff to retrieve and deposit checks.

Certainly, much of this can be attributed to the way the world began changing in March 2020. Businesses saw the need to quickly switch to electronic payments, as employees were largely away from offices and unable to issue paper checks. Similarly, businesses wanting to get paid in a timely manner didn’t want to wait for often delayed mail and then have to send staff to retrieve and deposit checks.

Several case studies demonstrate this transformation. One looks at how the creative firm Subject Matter encouraged its clients and vendors to switch to ACH payments. Also, to show that we walk the walk, Nacha was able to move more accounts payable and receivable to ACH.

Healthcare providers are also turning to ACH to receive claim payments. A record 108 million healthcare claim payments traveled the ACH Network in the second quarter, as doctors and dentists realize the value of bypassing paper checks. Nacha has prepared case studies with dentists who insist on ACH claim payments, including Dr. Amy Adair who particularly likes the “immensely faster” turnaround.

In the realm of consumer payments, many consumers have long seen the ease and convenience of using the ACH Network, particularly to pay bills. But those who might have been hesitant are increasingly moving in that direction. That’s reflected in the 2.2 billion consumer-initiated payments on the internet in the second quarter, an increase of 14.3% from 2020’s second quarter and 37.5% from 2019’s.

Person-to-person, or P2P, payments are also on the rise. There were 65 million in the second quarter, up 24.2% from 2020 and an astonishing 84.7% from 2019.

The growth in consumer use of the ACH Network should come as no surprise. After all, many have long realized the benefit of being paid by Direct Deposit.

The move to electronic payments by businesses and consumers is a positive change coming out of the past year and a half. Time will tell whether it continues, though it’s hard to envision a switch back to the old ways. Do you know anyone clamoring for VHS tapes or payphones?

We understand that for many people and organizations there have been sudden, significant changes to making and receiving payments. But the move to electronic payments by businesses and consumers is a positive change coming out of the past year and a half. Nacha and the ACH Network are proud to do our part.