ACH Network Volume Increases 9% in Third Quarter, as Commercial Payments Volume Rebounds

The ACH Network had exceptionally strong growth in the third quarter of 2020, with a resurgence of commercial volume even as some government assistance payments have largely concluded.

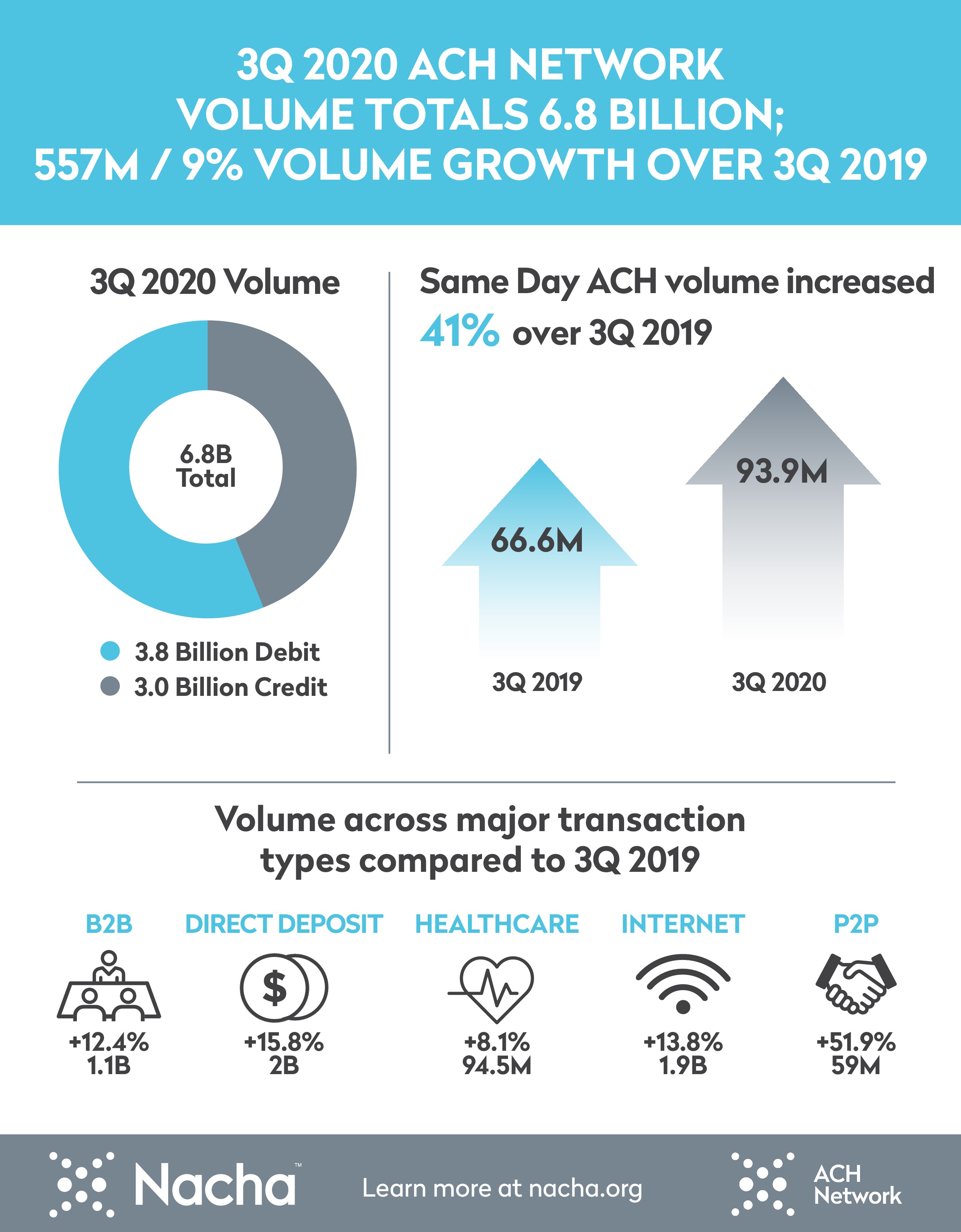

Volume on the ACH Network totaled 6.8 billion payments in the third quarter, a 9% increase from the same period in 2019. The value of those payments, $15.9 trillion, reflects a 13.1% increase. With one additional banking day in the third quarter of 2020 compared to the third quarter of 2019, ACH Network volume compared on a per-day basis increased by 7.3%.

Commercial ACH volume, initiated through the private-sector financial institutions, grew by 9.6%. Business-to-business (B2B) payments jumped by 12.4%. Healthcare claim payments to providers rebounded in the third quarter, likely due to more dental and medical offices reopening. The 94.5 million healthcare claim payments reflect an increase of 8.1% from a year earlier and 18.8% from the second quarter of 2020.

“The modern ACH Network serves the American people and businesses by delivering stimulus payments on time, and by enabling safe, remote electronic payments,” said Jane Larimer, Nacha President and CEO.

The continued shift away from paper payments to electronic payments was apparent in several categories during the third quarter:

• Direct Deposit increased by 15.8% to 2 billion payments.

• Person-to-person (P2P) transfers jumped 52%.

• Internet-initiated payments and transfers increased by 14%.

Additionally, this was the second consecutive quarter in which there was a 24% decline in check conversion payments, where a consumer’s paper check is processed electronically as an ACH payment.

This is consistent with Federal Reserve data showing a rapid decline in check payments. The Fed recently reported a 10.7% decline in the volume of commercial checks it collected during the second quarter of this year, the largest percentage drop since 1994’s first quarter.

“Electronic ACH payments are the proven way to make payments for wages and salaries, expenses, benefits, B2B and so much more,” said Larimer.

Adoption of Same Day ACH continued, with 93.9 million payments in the third quarter, up 41% over the same period last year. The average dollar amount per Same Day ACH payment rose 31%, continuing a trend that began with the March 2020 increase in the dollar limit per transaction to $100,000.

An infographic showing third quarter results is available for download as a PDF.