Larimer: Nacha and the ACH Network Poised for Future Growth

The last year and a half was turbulent, but through it all the ACH Network delivered for Americans when they needed it most, while also preparing for a strong future, Nacha President and CEO Jane Larimer said.

“The ACH Network demonstrated its role as a key part of the of the nation’s economic lifeblood during one of the greatest challenges of our lifetimes,” Larimer said in her keynote speech at Payments Remote Connect.

With more than $650 billion of economic aid payments made, and now $15 billion in child tax credit payments in the program’s first month, the ACH Network rose to the task, Larimer said.

“The pandemic also spurred changes in business and consumer behavior, further accelerating the nation’s shift from paper checks to electronic payments,” said Larimer, noting a record 2 billion new payments were added in 2020, resulting in “the highest growth rate since 2007.”

In her keynote Larimer also looked at some of Nacha’s key accomplishments in 2020, including later hours for submitting Same Day ACH payments; the launch of the SPEAK (Strengthening Payments Education and Knowledge) online learning platform in collaboration with the Payments Associations; the success of a pilot program for Phixius, a subscription-based data service platform facilitating the trusted exchange of vendor information; and the release of new resources from the Payments Innovation Alliance on best practices for voice payments and pandemic-related cybersecurity.

Larimer was also joined by Joe Hussey, Nacha’s Board Chairperson and Managing Director, North America Payables & Receivables Product Executive at J.P. Morgan, for a chat about the year in review and what the future holds for Nacha and the ACH Network.

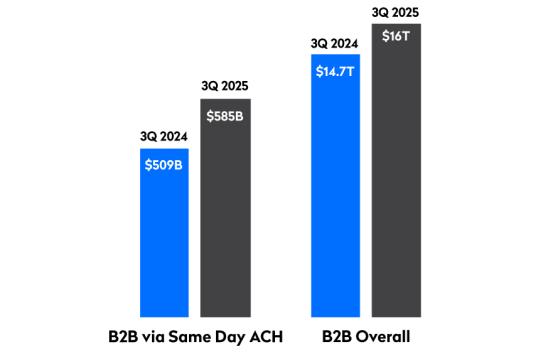

Among the topics they discussed was the significant increases in electronic B2B payments, with Hussey noting that “it’s hard to get two signatures on a check in a socially distanced world.” Both he and Larimer are optimistic that the shift away from paper will stick.

“The new generation says, ‘Why would I write a check?’” said Hussey. “When you translate that over into a corporate position, I think the same thing starts to take hold, which is, ‘How do I make sure all of these payments stay electronic?’”

Join Us at Payments 2022

Nashville, Tennessee | May 1-4, 2022