Same Day ACH

Same Day ACH payments can be used for a wide range of transactions, from paying bills to receiving payments of up to $1 million and can be processed in just a few hours. Unique to Same Day ACH among faster payment methods is the ability to reach virtually every bank and credit union account in the United States, making it a highly versatile and accessible payment method.

Businesses, government entities and consumers use Same Day ACH for a multitude of purposes, including:

Urgent Bill Pay

Life gets busy and stuff happens. Sometimes that stuff is forgetting to pay a bill, until your business realizes it missed a payment that’s due now. That’s where Same Day ACH comes in.

With Same Day ACH, you can have that bill marked “paid” in as little as a few hours. Same Day ACH payments settle three times daily, and each payment can be up to $1 million. And just like standard ACH, Same Day ACH can reach every bank and credit union in the U.S.

And if you’re running a business that likes to hold on to its cash as long as possible, you can plan to use Same Day ACH to pay bills when they’re due. That’s a major plus when forecasting your firm’s cash flow, as well as managing liquidity.

Ask your bank or credit union about the ways Same Day ACH can help your business.

Payroll

When payday rolls around, folks expect to get paid. But sometimes there are payroll errors. Someone didn’t get the right amount (or maybe didn’t get anything at all). Quickly turn that wrong into a right with Same Day ACH.

The days of having accounting write a last-minute check are over. With Same Day ACH, an employee can still get their money on payday, without taking an emergency check to the bank, depositing it, and waiting for it to clear. Instead, within a matter of hours, the money they’re due is in their bank account by Direct Deposit.

And Same Day ACH is also great for gig and hourly workers, as well as freelancers, all of whom really need their money when they earn it, rather than waiting for a regular payday. They can have a Direct Deposit in hours.

Ask your bank or credit union about the ways Same Day ACH can help your business.

Insurance Claims

No one wants to have an insurance claim. Whether it’s a banged up car, or a burst water pipe, people need their insurance money quickly to get back on their feet.

Same Day ACH is a tremendous help with insurance claim payments. In a matter of hours, the money they need is safely Direct Deposited into their bank account. That means they can immediately use it to deal with their urgent needs, be it a hotel, a new set of wheels—whatever. With Same Day ACH, insurers can help their customers at a time they need help most.

Ask your bank or credit union about the ways Same Day ACH can help your business.

Disaster Relief

Natural disasters often leave behind incomprehensible damage. Those left reeling need help quickly.

Government agencies and charitable organizations can get relief out quickly and safely using Same Day ACH.

With Same Day ACH, relief funds can be safely Direct Deposited within a matter of hours. People can get the help they need faster than waiting to receive or deposit a check.

Same Day ACH is an easy, inexpensive way to get relief where it needs to go, when it needs to get there.

Refunds

Sometimes you owe your customers a refund. Whether they’re consumers or fellow businesses, you’ll find they’re both pleasantly surprised—and very satisfied—when you make that refund via Same Day ACH.

If your customers paid you by ACH you may already have the information you need to make a refund the same way. And if your organization is still printing and mailing refund checks, it’s really time to get with the times. Same Day ACH gets customers their money in hours. It’s fast and it’s easy (not to mention a lot less expensive than the paper check route). It’s also something they’ll appreciate—and might just remember the next time they need a product or service you provide.

Ask your bank or credit union about the ways Same Day ACH can help your business.

Reimbursements

Employees often have expenses. Whether it’s business travel, a purchase on the company’s behalf, or something else that comes up, they’re laying out their own money. When your staff does right by the organization like that, you can do right by them by reimbursing them quickly. Same Day ACH will get it done.

With settlement times throughout the business day, an employee can turn in an expense report in the morning and find the money in their account that afternoon. That brings their balance back up and enables them to promptly pay any credit card charges they made on the organization’s behalf.

Check with your financial institution about using Same Day ACH for reimbursements.

Tax Payments

Taxes are a fact of life, especially for businesses, which have many different types of taxes they’re required to pay, often to several different governments. There’s a fair bit of money involved, and it can really make a dent in cash flow. Same Day ACH can help with that.

Rather than sending a standard ACH tax payment ahead of time, or mailing a check (something no one should be doing), organizations today can use Same Day ACH. Tax payments get where they’re going safely and reliably, and they can arrive on the due date. That means no late fees or penalties, while your business holds on to its money as long as possible.

Ask your bank or credit union about the ways Same Day ACH can help your business.

Account-to-Account (A2A) Transfers

Banks and credit unions offer customers the ability to transfer funds from other accounts they have at other financial institutions.

Whether for funding new accounts or facilitating savings, these account-to-account (A2A) transfers are an important part of many people’s financial management.

These transfers can be improved with Same Day ACH, a very low-cost and rapid way to allow customers to move funds from accounts at other financial institutions. Your customers will be pleased when they see the transfer land in their account in just a matter of hours.

Credit Card Issuers

Credit card issuers collect a lot of bills. When a cardholder wants to make a payment, collecting funds quickly is important to keeping more credit available to the customer and reducing risk of loss to the issuer.

Same Day ACH is available with several settlement times each business day. It’s a low cost and rapid way for your organization to quickly receive your customer’s payment.

Same Day ACH Success Stories

To truly appreciate the impact of Same Day ACH, reading success stories is a great way to see real-world examples of ACH’s faster payment option. We invite you to take a closer look at some of the ways Same Day ACH is making a difference.

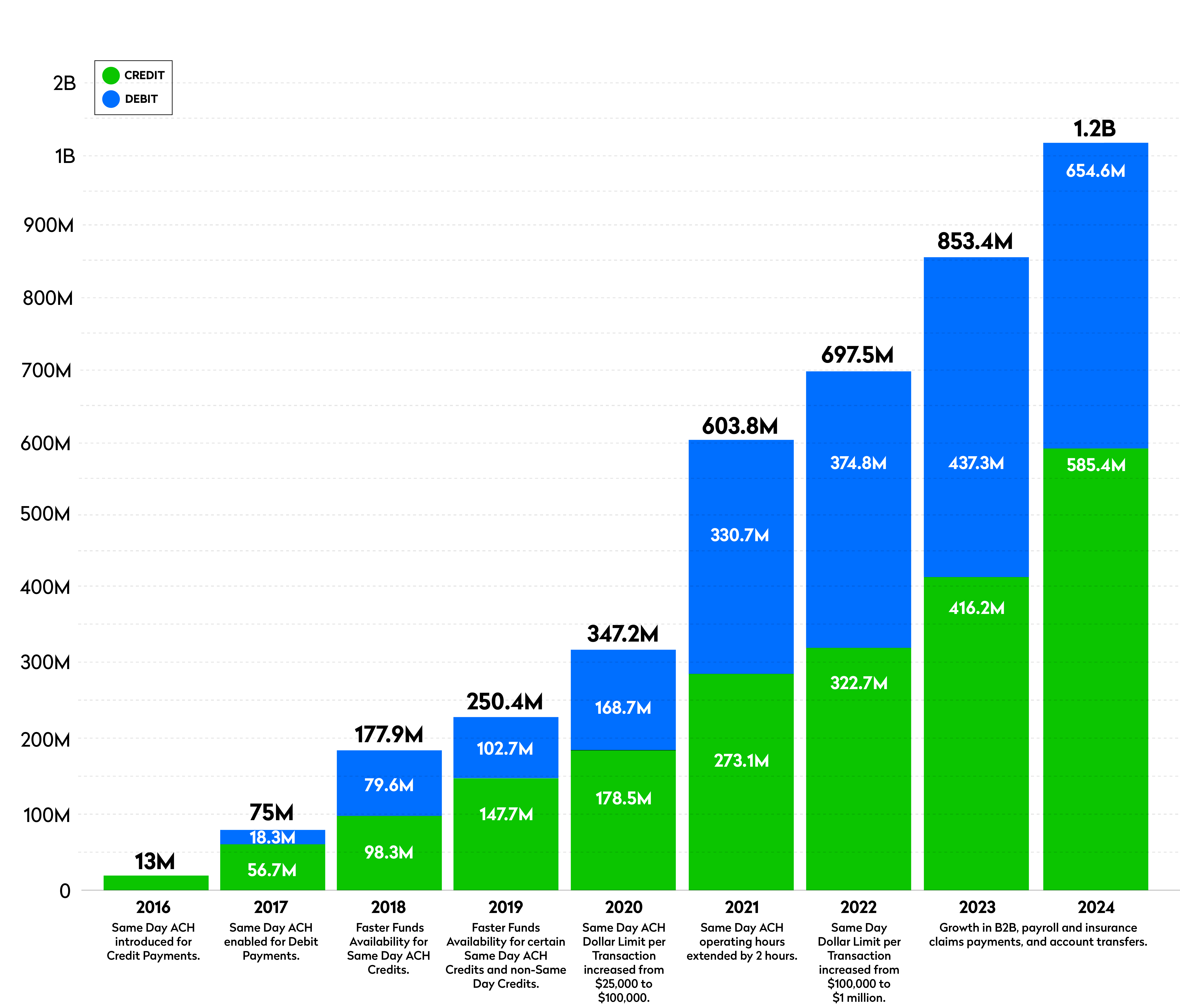

Same Day ACH Volume and Dollar Value Growth

In 2024, Same Day ACH payment volume topped the 1 billion mark, with more than 1.2 billion payments for the year. The value of those payments was $3.2 trillion. From 2023 to 2024, Same Day ACH volume soared 45.3%, more than double the growth rate from 2022 to 2023.

Nacha News on Same Day ACH

From podcasts to blogs and press releases, access all Nacha news content covering Same Day ACH.

Ready to experience the speed and efficiency of Same Day ACH?

Contact Nacha Consulting to learn more about how Same Day ACH can benefit your business and how to get started.

Same Day ACH History

Same Day ACH debuted in September 2016 for credits, with 1.3 million payments in its first six processing days. Debits were added in 2017, and by its fifth anniversary in September 2021, Same Day ACH had recorded a total of 1.2 billion payments.

Since its launch, Nacha and ACH Network stakeholders have continued to provide Same Day ACH enhancements, which have been key to its growth.