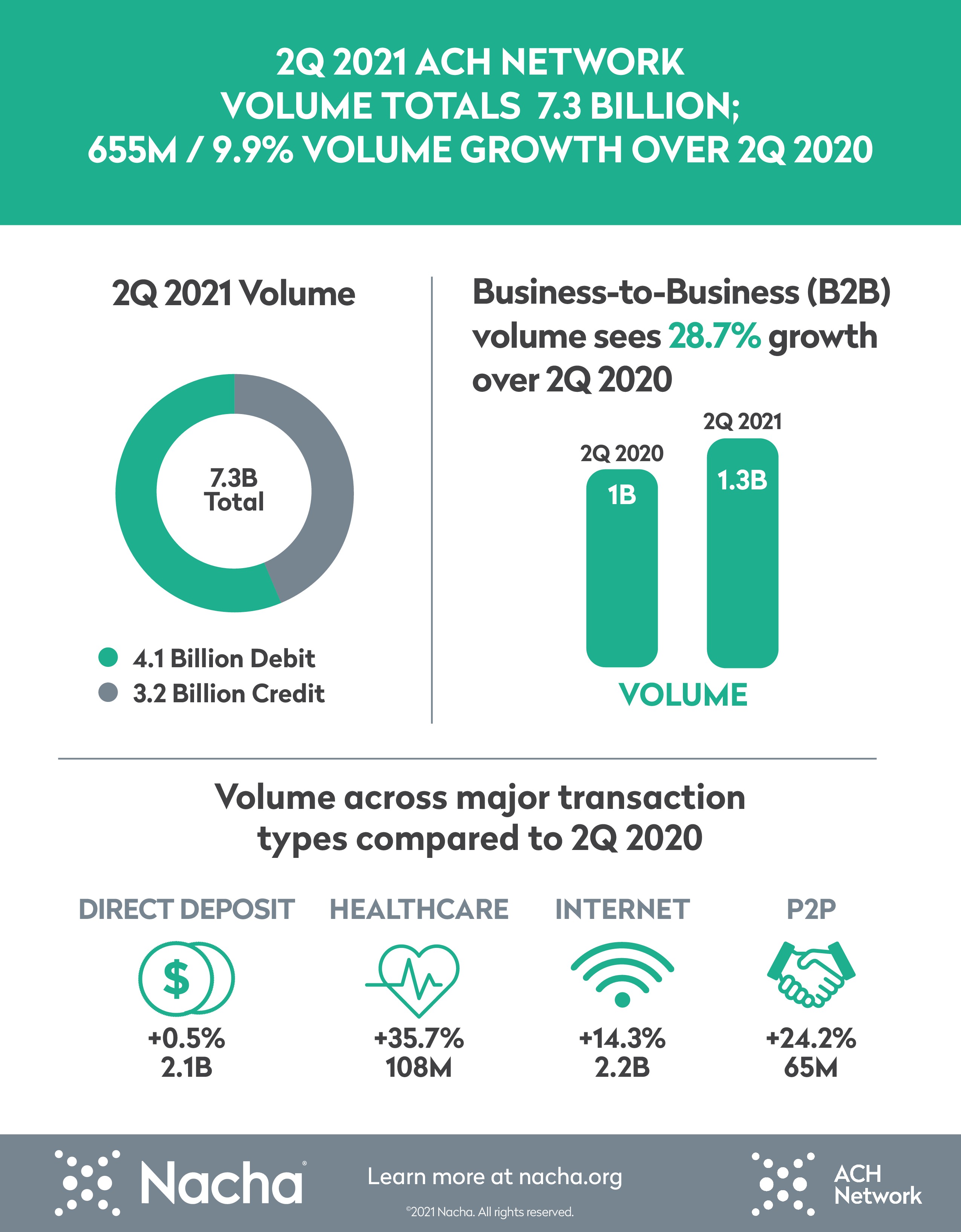

Strong Growth Continues for ACH Network as Volume Climbs Nearly 10% in Second Quarter of 2021

Robust growth continued for the modern ACH Network in the second quarter of 2021. Payment volume climbed 9.9%, with particularly strong growth in business-to-business (B2B) payments.

The ACH Network processed 7.3 billion payments in the second quarter, 655 million more than the same time in 2020. The value of those payments was $18.4 trillion, an increase of 24.6% from a year earlier.

B2B payments increased 28.7%, to 1.3 billion payments.

“While the B2B segment was growing before the pandemic, the transformation of business payments from paper has greatly accelerated over the past year,” said Jane Larimer, Nacha President and CEO. “The ACH Network is here to enable fully electronic business-to-business payments.”

Healthcare was also an active segment, with a record 108 million claim payments in the second quarter, up 35.7%.

“Medical and dental providers are increasingly realizing the many advantages that come with having claims directly deposited to their accounts,” said Larimer.

The volume of consumer-initiated payments on the internet increased by 14.3%, to 2.2 billion payments. Person-to-person payment volume increased by 24.2%, to 65 million payments.

About Nacha

Nacha governs the thriving ACH Network, the payment system that drives safe, smart, and fast Direct Deposits and Direct Payments with the capability to reach all U.S. bank and credit union accounts. Nearly 27 billion ACH Network payments were made in 2020, valued at close to $62 trillion. Through problem-solving and consensus-building among diverse payment industry stakeholders, Nacha advances innovation and interoperability in the payments system. Nacha develops rules and standards, provides industry solutions, and delivers education, accreditation, and advisory services.