Ready to Sign Up for Direct Deposit with Your Employer?

Ask Your Employer

The first thing to do is to ask your employer if they offer Direct Deposit. If you work at a small place, check with your boss; in a larger firm, ask the human resources department.

Finding Your Routing and Account Number

To sign up for Direct Deposit, you will need two pieces of information: The account and routing numbers for the bank or credit union account(s) you want to use. Finding those is simple and there are different ways to go about it:

Open the bank or credit union website or app

Log in to your bank or credit union’s app or website. Some will have the information available under a tab such as “Account Management” or “More.” You can also use the search. Enter “Routing Number” or “Account Number” which should lead you to what you need.

Check a paper check

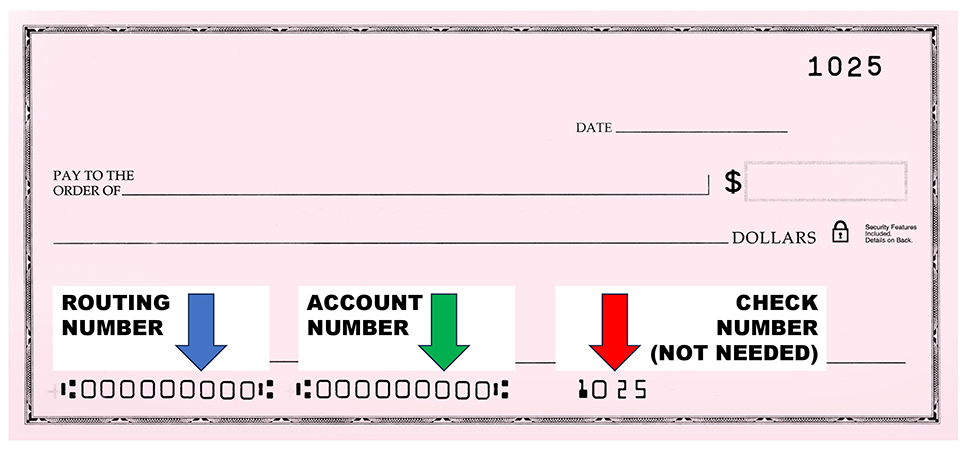

If you have a checkbook handy, open it and look at the bottom of a check.

See all the numbers running across the bottom? Starting from the far left, there is a nine-digit number. That is the routing number. After that there is a space and then another set of numbers, which is the account number. This can be between eight and 17 digits long. After another space, the last set of numbers is the check number, which you do not need.

Pick up the phone

Call your bank or credit union’s customer service number. After verifying your identity, they can provide you with your account and routing numbers.

At a minimum you will need one account—checking or savings—for your wages to be deposited to.

The Split Deposit feature of Direct Deposit can help you build a nest egg for just about anything. Saving automatically is easy, and it’ll help you reach whatever your goal is, be it a down payment on a home, a new car, or just having savings for whatever life throws at you.

To use Split Deposit, have the account and routing numbers ready, and then ask that your Direct Deposit be split among your accounts. For example, you can ask that each payday 85% goes to checking and 15% goes to savings. Or ask that a set dollar amount go to savings with the rest to checking. No need to transfer funds—it’s all automatic. And it adds up. For example, $40 saved weekly is $2,080 saved annually.

If your employer does not offer Direct Deposit, ask them to consider it. Direct Deposit is safe and convenient for both employees and employers.